At almost every level of higher education, students complain that tuition costs are too high, class materials cost too much and it is otherwise too costly to live while putting in the work to get that college degree.

The bottom line is that spending money on tattoos, cigarettes and other luxuries not essential to the completion of your education when you don’t have the money reeks of recklessness.

Free college and credit can be beneficial but taking personal responsibility for financial shortcomings is the hallmark not only of being a responsible student, but of being a future leader.

Many students, including those here at American River College, have a problem with spending their money in a way that is consistent with the lifestyle that comes with the choices they have made.

It’s no secret that pursuing a college education in hopes of a more financially and intellectually prosperous future can present income challenges along the way, but accepting these roadblocks and overcoming them is a decision that every student must make if they are to succeed.

According to Nationwide Insurance, 40 percent of college students’ spending is discretionary, meaning money spent on nonessential items such as technology, entertainment and cosmetics.

Part of what makes a college student successful is the ability to stretch their dollar in order to afford the often exorbitant prices associated with college.

In other words, students must be willing to make sacrifices in order to graduate. This is no different from achieving and setting goals for anything in life.

The journey to this destination is enriched by the pitfalls that we overcome in the process.

Yes, this means possibly giving up the amenities that others may enjoy in order to afford that math textbook.

While many students take this knowledge to heart and make the necessary cutbacks, others find themselves dedicating money towards other, less productive, means.

Frankly, it is difficult to take the financial complaints of students seriously and from a state of empathy when those same students show up the very next day to school with a new phone, pack of cigarettes or a fresh new set of tattoos.

Not enough students understand the sacrifices that, for better or worse in our modern world, must be taken on the road through college.

This irresponsibility is simply not a surprise anymore when you consider that total outstanding U.S. student debt was $1.16 trillion as of March 2015, according to the Federal Reserve of New York.

While students certainly share blame for their own financial decisions, the fact that this debt has been increasing for the past 45 years leads one to believe that the time has come to question if the institutions set in place prior have failed us.

Perhaps in our education system’s rush to teach us the dry and straightforward facts about history and math, it has forgotten that one of the most important things for an adult to not only learn but exercise, is financial literacy.

Elementary school curriculum does not normally consist of educating young pupils on the importance of certificate of deposits in generating residual wealth.

High school courses are not stringent on teaching students on the financial flexibility and prosperity that can come with investing in stocks.

Even at an institution of higher learning such as American River College, where financial literacy would be of utmost importance, there is no significant outreach to students to educate and enrich them in this endeavor.

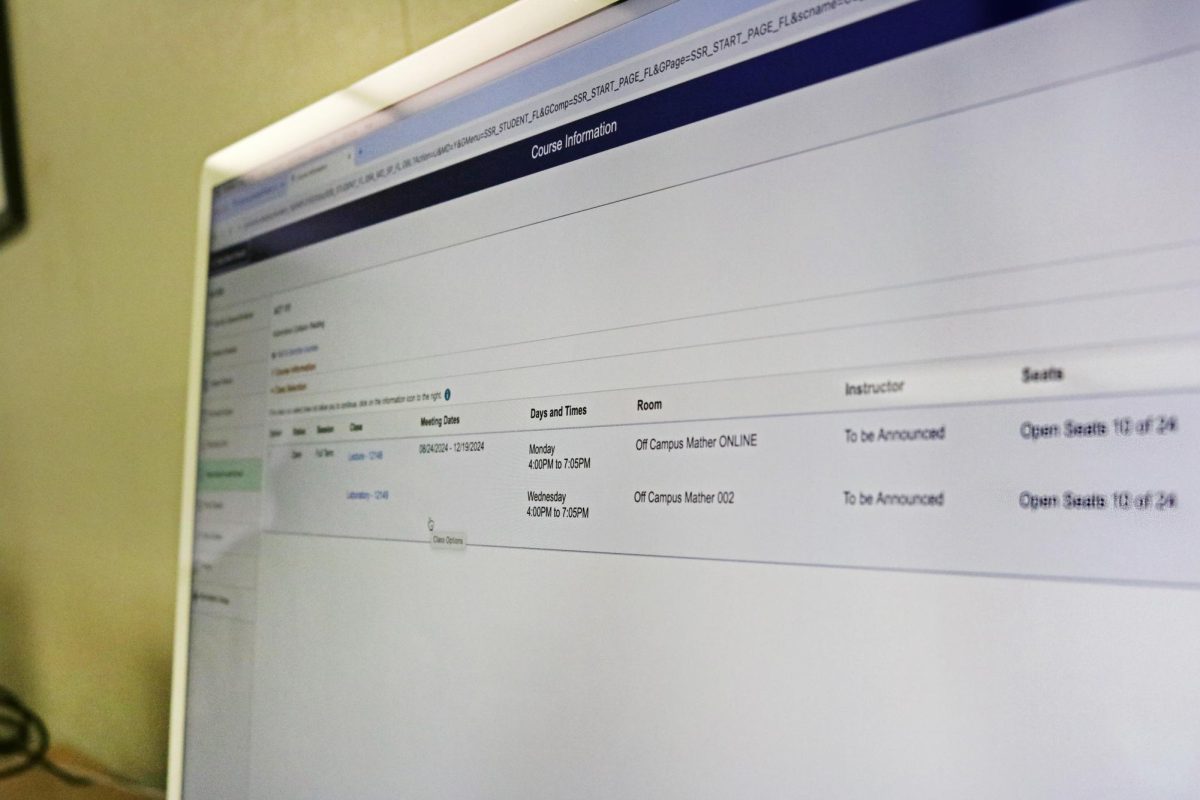

ARC offers only one course in financial literacy, ECON 320, which teaches students how to analyze financial affairs for lifelong decision making, according to the course description.

One course at one of the most populated community colleges in the state is not enough. Short dialogues on financial sustainability in the educational sector are not enough.

Focusing on financial literacy advocacy for young Americans as soon as they leave the cradle is an important step in remedying the problem, but at the end of the day college students must take accountability in how they spend what they have in order to ensure their ultimate success.

That new iPhone or makeup kit endorsed by the hot new celebrity of the week can wait because unlike both of these, a college degree and the experiences that come with it last a lifetime.